Sparados' Record Growth in 2025: How We're Changing the Way Corporate Spend is Managed Across Europe

- Justyna Mazurek

- Dec 29, 2025

- 5 min read

Updated: Jan 14

The year 2025 was a breakthrough for Sparados. From the perspective of the team, which has been building a business expense management solution from the outset with the real needs of companies in mind, we can clearly see today that we chose the right direction. The scale of growth we achieved over the last 12 months confirms one thing: Polish companies – especially those in the SME segment – are ready for modern, digital management of operational finances.

The 2025 summary is more than just numbers. It's also a story of changing thinking about corporate cards, cost control, financial transparency, and accounting process automation.

Sparados' Record Growth in 2025: The Year of Product Scaling and Maturity

Since Sparados 's inception, we have focused on the expense management and corporate card issuing product that significantly reduces the workload of finance, accounting, and operations teams. In 2025, we focused on scaling both the technology and our customer base. The results of this strategy are visible in key operational metrics.

The number of active Sparados cards increased by 267.5% year-over-year. This is one of the most important signals for us, because each new card represents a real implementation of our solution in the daily work of customer teams – not a test, not a pilot, but actual use.

The number of transactions also increased accordingly. In 2025, Sparados users completed 219,702 transactions, representing a 142.1% increase compared to 2024.

Sparados as a Tool for Everyday Work

In 2024, a Sparados card transaction occurred on average every 5 minutes and 48 seconds. In 2025, this time was reduced to 2 minutes and 22 seconds. For us, this is one of the most important proofs of the high usability of our solution for businesses.

Sparados has gone from being an add-on to financial processes to an integral part. Our cards are used for business payments for software, marketing, business travel, operational purchases, and subscription services — wherever speed, control, and full cost visibility are key.

It is the frequency of use that best demonstrates the retention and real value of the Sparados product in the B2B model.

Over PLN 71 Million - Value of Sparados Card Transactions

We closed 2025 with a total transaction value of PLN 71,136,200, representing an increase of approximately 95% year-on-year. Doubling our volume while dynamically increasing the number of transactions is a clear signal to us that the platform is effectively scaling with our customers.

From the perspective of a fintech company handling corporate payments, system stability and reliability are absolutely crucial. Growing volumes cannot mean compromising the security, availability, or quality of financial data. We consider the fact that more and more companies entrust us with a growing portion of their operating expenses a sign of trust — and a significant responsibility.

Indicator | 2024 | 2025 | Growth (%) |

Number of transactions | 90 751 | 219 702 | 142.1% |

Card transaction at what intervals | 5 min 48 sec | 2 min 22 sec | — |

Transaction value (PLN) | 36 495 593 | 71 136 200 | 95% |

Why Do Companies Choose Sparados?

Analyzing the data for 2025, we see three key factors behind our growth.

1. Eliminate bureaucracy and manual processes

Businesses are tired of manually collecting receipts, manually recording expenses, and having no control over company cards. Sparados automates these processes, providing full transparency in real time.

2. Scalable B2B model

The nearly threefold increase in the number of corporate cards issued shows that clients are not only joining us but also expanding their partnerships, issuing cards to additional employees and teams. This is the best evidence of our product-market fit.

3. Integration and ecosystem

From the outset, we've built Sparados as part of a larger financial ecosystem. Our partnerships, including with financial technology provider Verestro and payment institution Quicko, allow us to more quickly develop features that truly support finance and accounting departments.

Voice of the Management Board: What Do the Market Data Say?

Michał Stachera, CEO and co-founder of Sparados, sums up 2025 and talks about the goal for next year:

"The 2025 results are proof that Polish companies truly need tools that eliminate bureaucracy. Reducing the time between transactions from nearly six minutes to just over two shows that Sparados has become an essential everyday operational tool for thousands of employees. In 2026, we're not going to rest on our laurels. We want to achieve at least three times better results."

From our perspective, this also signals a broader market trend. Corporate operational finance is entering a phase of deep digitalization — much like retail banking and consumer payments before it.

What's Next? Major: Accounting, KSeF, Benefit Platforms

Looking ahead, we envision 2026 as the year for further integration of Sparados with accounting systems and the National e-Invoice System (KSeF). Our goal is to create an environment in which expense data flows automatically between the card, the financial system, and accounting — without manual interventions or delays.

We want business expense management to be not only fast, but also fully auditable, compliant with regulations, and friendly to finance teams.

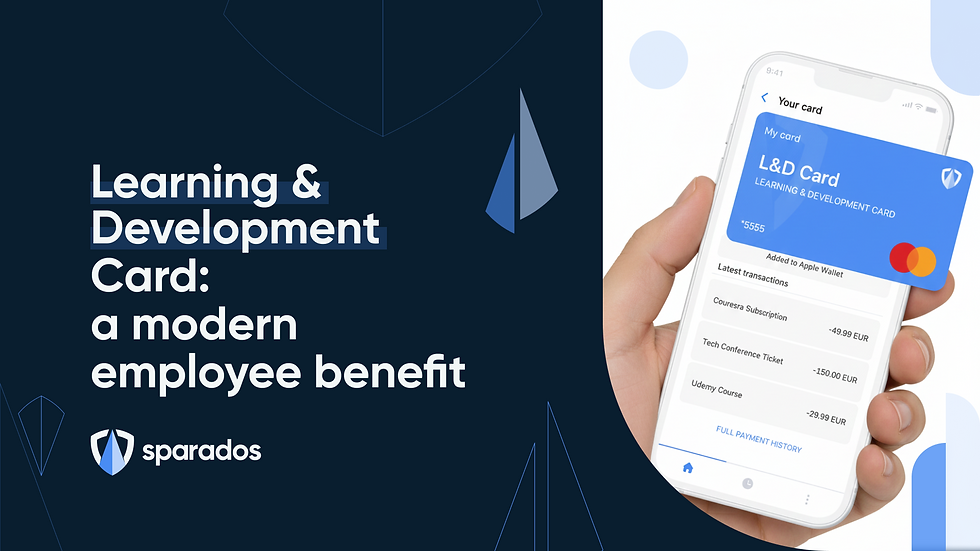

We've also seen increased interest in our virtual cards among cafeteria systems. Therefore, in 2026, our infrastructure has the potential to become the foundation for modern incentive programs in companies.

“Our offer has been enriched with another element, thanks to which we can provide software for benefit and cafeteria platforms, allowing them to enrich their portfolio with innovative benefits based on payment cards, increasing the value offered to clients and partners”, emphasizes Michał Stachera.

Sparados In the First League of Polish Fintechs

As we approach 2025, we see Sparados as one of the fastest-growing fintechs in Poland, focused on real-world business problems. The dynamic growth in the number of cards, transactions, and volumes confirms that the market is ready for a new standard in corporate expense management.

If you want to learn more about how Sparados was created and what our plans are for the future, we encourage you to watch the interview with our CEO below (in PL), who explains the genesis of the Sparados project and discusses its competitive advantages.

The year 2025 shows that we're on the right track. And this is just the beginning. Follow our blog and stay up to date!