How Benefit Cards Support Employee Development

- Justyna Mazurek

- Dec 19, 2025

- 5 min read

Updated: Dec 29, 2025

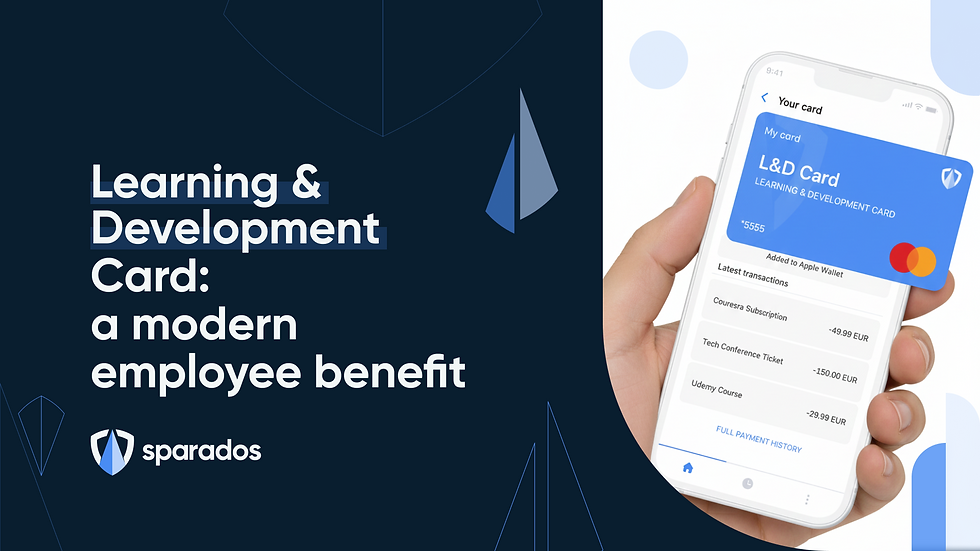

The modern labor market demands that companies not only offer competitive compensation, but also strategically invest in the continuous development and well-being of their employees. A key element of this strategy is the Personal Development Budget (PDB), and the most innovative and convenient way to implement it is through an employee benefit card for training.

Forget the tedious process of collecting invoices and waiting for reimbursement, which often demotivates those looking to take a quick course. These days, development is virtual, immediate, and... accessible via payment card. This is a revolution in human resources management that prioritizes autonomy, efficiency, and trust.

Personal Development Budget: A New Era of Flexibility

Traditional training plans have often been top-down, pre-planned for large groups, and rigidly tied to a narrow career path within the company. Personal Development Budget reverses this logic, placing control in the hands of the employee.

What is the Personal Development Budget (PDB)?

PDB is a predetermined annual amount that an employee can use fully autonomously for educational purposes of their choosing. The decision on how to spend these funds becomes an element of the contract and mutual trust.

Two Pillars of Development: Investing in Full Potential

The most progressive companies divide PDB into two areas, accepting that employee development is more than just hard skills:

Professional (service-related) development: Investments directly related to improving qualifications in a current or future position. These include obtaining market-recognized certifications, advanced programming courses, specialized team management training, and participation in international industry conferences.

Personal development (hobby): This pillar is a symbol of modernity. Companies, especially those in the IT, technology, and innovation sectors, offer budgets for development unrelated to work, demonstrating their commitment to mental and physical well-being and creativity. Examples include cooking classes, instrument lessons, ceramics workshops, meditation courses, speed reading courses, or learning a foreign language for pure enjoyment. Developing soft skills and non-professional interests minimizes the risk of burnout and increases overall job satisfaction.

Benefit Cards: The Convenience of Immediate Payment

While PDB can be implemented through traditional reimbursement (reimbursement of costs after submitting an application), a dedicated benefit card (prepaid, virtual, or physical) is the most convenient and fastest solution. It works like a regular payment card, with the difference that it is topped up with funds intended solely for development.

Benefit for the Employee | Benefit for the Employer |

Speed of decision and payment: You can pay for the course immediately when an attractive promotional offer appears. | Simplified administration: Significant relief for HR and Finance departments from handling large numbers of reimbursement applications. |

No tying up your own funds: You don't have to pay large sums out of your own pocket for expensive training. | Better budget control: Ability to precisely track fund usage and allocation in real time. |

Transparency: Access to balance and transaction history (often via a mobile app) eliminates uncertainty. | Supporting proactivity: Promoting an attitude of "take responsibility for your development". |

Benefit Cards in Practice

The possibilities of using the benefit card are wide and depend on the company policy:

Online education: Pay for subscriptions and individual courses on global platforms like Udemy, Coursera, EdX, and LinkedIn Learning.

Conferences and events: Registration and purchase of tickets for conferences (including virtual ones), often including travel and accommodation costs if the company provides for it as part of the IBR.

Purchase of development tools: Purchase of professional books, e-books, specialized subscriptions to industry knowledge bases.

Individual services: Payment for coaching, mentoring, therapy sessions (if the company combines PDB with wellbeing).

MCC Codes: Technical Constraints and Spending Controls

Although a benefit card is a symbol of freedom, in practice its use is strictly controlled by technical mechanisms, the most important of which is the so-called Merchant Category Code (MCC).

What is the Role of MCC?

MCC is a four-digit code assigned to each merchant by payment organizations (Visa, Mastercard) based on their primary activity. Banks and benefit card providers use this system to geolocate spending into categories and then impose restrictions.

When establishing a policy for using the benefit card, the employer may:

introduce a "whitelist": The card only works with merchants with specific codes, ensuring targeted spending. Example codes for education are 8299 (Other schools and educational services) or 8244 (Business schools).

introduce a "blacklist" (Blacklist): The card does not work in categories that are clearly excluded (e.g. casinos, liquor stores, bars - codes 5813 , 7995 ), even if the PDB policy is liberal.

Key Differences in Benefits: Tax and Legal Aspects (in Poland)

The most important issue that complicates the use of a benefits card is the legal and tax aspects of the type of employee benefit. Whether training is considered taxable income for an employee depends on its relationship to their job duties.

Expense type (paid by card) | Legal basis and status | Consequences for the employee |

Professional development (Improving qualifications in the position – employer's initiative/consent) | The value of the benefit goes to the employee in 100% (the benefit is not reduced by taxes and contributions). | |

Personal development (hobby, courses unrelated to the company – e.g. cooking lessons) | Taxable and contributory (treated as "other gratuitous benefit" from the employment relationship). | The value of the benefit must be added to the employee's monthly income and is subject to personal income tax and social security contributions, just like a regular salary. |

For Employees: Conscious budget management is essential. When paying for a ceramics course (personal development) by card, you should expect the course value to be added to your tax base for the month.

For Employers: This requires the creation of precise and clear internal policies that define what constitutes "professional development" and what does not. Employees should also be informed that some of the funds may be consumed by mandatory public contributions.

The Future of Employee Learning & Development

Individual benefit cards are the future of talent management. In an era when competencies are becoming obsolete at a dizzying pace and the need for upskilling and reskilling is critical, ensuring easy access to education is a priority.

Companies that successfully implement this model see not only increased employee satisfaction but also tangible business benefits, such as higher talent retention and increased innovation resulting from the diverse skills acquired by the team. A benefit card is a symbol of trust – and trust, combined with investment in people, is the most powerful motivator.

Sparados: Turn your Development Strategy into a Convenient Employee Benefit

The theoretical benefits of implementing Personal Development Budgets are undeniable. However, fully realizing the potential of PDB requires a modern tool that combines flexibility with administrative control. This is where a platform like Sparados comes in.

With virtual benefit cards available directly in the Sparados app, your employees in Poland gain immediate and convenient access to funds for courses, training, and conferences — no need to wait for a physical card. Sparados allows for easy budgeting, precise limit setting, and expense monitoring, supporting the management of company finances and employee benefits. This solution eliminates bureaucracy and builds trust and a culture of continuous development within your organization.

Contact Sparados and learn how to sign up for the Sparados corporate finance and card management platform to revolutionize your employee benefits today.

Read more about modern employee benefits: