A Modern Solution for HR Tech: Integration of Virtual Cards

- Justyna Mazurek

- 6 days ago

- 4 min read

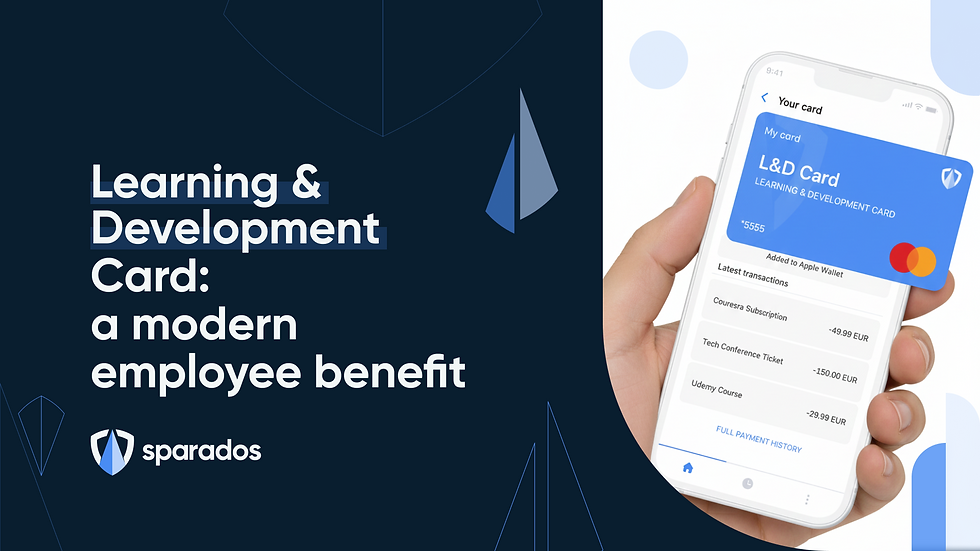

The integration of virtual cards on benefit platforms is a modern solution that combines the flexibility of a cafeteria with the convenience of digital payments, enabling the instant generation and use of virtual cards for contactless payments (via Apple Pay, Google Pay) or online, funded from a benefits pool, which facilitates benefits management and increases employee satisfaction through personalization.

Benefit/HR Tech platforms can expand their offerings with virtual cards, automating the process of spending funds on employee benefits, which is a more convenient alternative to traditional physical cards and vouchers. Learn more about how to implement virtual cards.

Table of Contents:

Integration at Your Fingertips

Integrating cards with a benefit platform does not have to be a complex, multi-year initiative requiring cooperation with a “constellation of institutions” — from BaaS providers to AML and KYC companies. The answer is Embedded Finance, meaning the integration of financial services directly into non-financial business platforms. Thanks to solutions such as Sparados, implementing virtual cards has become a true “plug and play” process, removing barriers that once held back even market giants.

What Is Embedded Finance?

Embedded Finance is a model in which banking and payment services — such as card issuing, account management, or transaction processing — are “built into” applications that users already rely on every day. Instead of redirecting the customer to an external bank, the benefit platform itself becomes the access point to financial services.

For end users, this means seamlessness and convenience. For platform owners, it means full control over fund flows and access to valuable analytical data — all without holding a banking license.

From a Financial Model to an Infrastructure Model

The traditional path to issuing payment cards requires carrying the full financial and compliance burden (SCA, BIN sponsorship, etc.), which can cost hundreds of thousands and take up to a year. When integrating with your benefit platform, your focus should be on user experience, while Sparados acts as the financial infrastructure layer. This approach reduces time-to-market to as little as one week.

How to Integrate with the Sparados Platform?

Integration is flexible and depends on your platform’s technological resources:

Out-of-the-box model: The fastest route, with no developer involvement. The company uses a ready-made admin panel, while employees receive cards via the Sparados mobile app.

API integration: Designed for IT systems. Enables automatic card issuance and top-ups triggered by events (e.g. a bonus).

No-code / white-label model: Full visual customisation (your logo, colours, domain) without the need for a development team.

Option 1: Ready “Out-of-the-Box” Solution

The quickest path for companies that want to immediately offer benefits to employees without engaging their own developers.

How it works: You register in the system and instantly gain access to a ready-to-use platform.

User interface: Employees receive corporate cards via a ready mobile app or a dedicated web page.

Management: All processes (card issuance, limits, users) are managed through Sparados’ intuitive admin panel.

Option 2: Integration via the Sparados API

If you already have your own benefit platform or cafeteria system with IT support, this option allows you to build an “intelligent” benefits system.

System integration: You connect your IT system to Sparados via API.

Event-driven actions: Cards can be issued or topped up automatically based on specific events in your system (e.g. work anniversary, monthly lunch budget allocation, promotion).

Card delivery: Employees still receive and manage cards using Sparados’ secure mobile or web infrastructure.

Option 3: No-Code Model with Your Own Branding

An ideal solution if you don’t have a development team but want the service to look like your own proprietary product.

Visual customisation (white label): Use the Sparados client panel to adapt the web app’s appearance to your visual identity.

Employee communication: Sparados configures branded email communication so employees receive notifications and instructions with your logo and tone of voice.

Result: You build the prestige of a modern employer, using ready-made infrastructure under your own brand.

Automated Card Issuance and Lifecycle Management

Instead of manual requests, your platform can initiate financial actions based on user behaviour:

Instant issuance: Create a virtual card the moment an employee selects a specific benefit (e.g. lunch or sports benefit).

Real-time delivery: Once issued, card details can be instantly added to Apple Pay or Google Pay within your app, enabling immediate payments.

Automated management: Your system can automatically block, unblock, or cancel cards depending on employee status (e.g. termination or benefit expiry).

Implementing Precise Spending Rules (Programmable Spending)

A key element of integration is ensuring funds are spent strictly for their intended purpose. Each virtual card can be programmed with:

MCC restrictions: Limit spending to specific merchant category codes (e.g. restaurants for meal benefits or medical facilities for healthcare packages).

Spending limits: Set daily, weekly, or monthly limits and use the API to instantly increase budgets (e.g. a one-off remote-work allowance).

Currency permissions: Configure cards to operate in selected currencies (PLN, EUR, USD), supporting international teams.

Leveraging White-Label Personalisation

To maintain a premium customer experience, you can fully align financial services with your brand:

Visual identity: Personalise the app and card-pickup page with your logo and corporate colours.

Domain integration: Publish the card-pickup portal under your own company domain, ensuring a seamless transition from the benefits menu to the virtual card.

Why Choose Sparados as Your HR Tech Solution?

Choosing Sparados is more than adding a new feature — it’s a strategic move that positions your platform at the forefront of HR Tech innovation. Key reasons include:

Lightning-fast time-to-market: Instead of waiting a year, your benefits programme can launch in as little as a week.

No compliance barriers: Sparados handles AML, KYC, KYB, and relationships with banks and card schemes.

Security and flexibility: You can freely programme how funds are spent (e.g. sport, health, meals), making you “dangerously competitive” in the job market.

By using Sparados as a ready-made financial layer, benefit platforms can evolve from simple “coupon catalogues” into full-fledged financial tools that give employees instant, flexible, and personalised purchasing power. Ready to innovate? Contact us today!